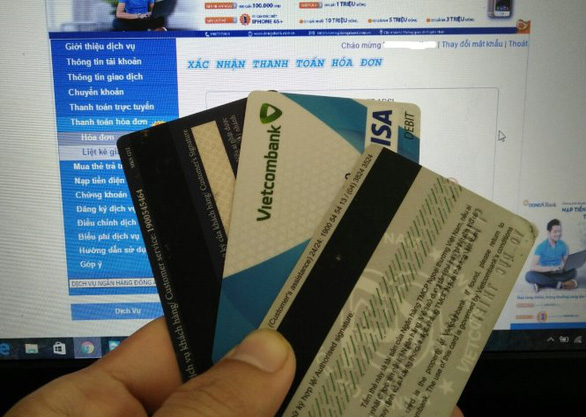

EMV technology is welcomed by banks in Vietnam for its security level against identity theft

Chips of EMV, short for Europay, MasterCard, and Visa, standards will replace the magnetic stripes on cards issued by Vietnamese banks, starting March 2021.

The adjustment was proposed in a bill to amend the State Bank of Vietnam’s Circular 19/2016 on bank card operations.

According to the central bank, this regulation is meant to enforce the adoption of EMV chip cards, as some of the banks were found disregarding the roadmap toward uniform chip card usage by 2021 by continuing to issue new magnetic strip cards.

The new circular, slated to come into effect on March 1, 2021, will give time for banks to implement plans to cease magnetic stripe card issuance.

Pursuant to banks’ realistic progress in adopting the new technology, the State Bank of Vietnam also extended the deadline for card accepting stores and services in Vietnam to integrate the EMV chip-compatible card readers into their systems by December 31, 2021.

Earlier, the central bank envisaged a complete transition from magstripe to EMV chips in cards and card payment systems by the end of 2021.

However, as COVID-19 proved a major hindrance to the project, multiple banks have petitioned for that deadline to be pushed back further.

The EMV technology is nonetheless welcomed by banks for its improved security level against threats of identity theft, which was considered a major flaw of magstripe technology that criminals have leveraged to forge cards.

The technology is also anticipated as it paves the way for contactless payment – one of the most up-to-date applications in financial technology.

However, EMV chips are not the endgame, as more streamlined, ergonomic technologies for the benefit of customers are coming from big players in payment solutions.

Recently, Mastercard has teamed up with Tappy Technologies, a world leading wearable payment integrator, and MatchMove, a Singapore-based fintech, to introduce a new tokenization chip which can be attached to a range of battery-less wearables and accessories such as watch straps or keyrings, turning them into secure contactless payment devices.

Meanwhile, Asian consumers are moving to contactless payment for everyday purchases as they seek cleaner, touch-free options, a 2020 Mastercard study shows.

After the impact of the COVID-19 crisis, 91 percent of the Asia-Pacific consumers say they are now using tap-and-go payment, while 75 percent state they will continue to go contactless after the pandemic is over, the study suggested.