In this Q&A with Filippo Bortoletti at Dezan Shira & Associates, we discuss Vietnam’s medical devices industry and opportunities for investors

During the last decade, Vietnam has been experiencing rapid economic and population growth, making the country an attractive investment destination for foreign investors in the public healthcare sector. The Vietnamese healthcare industry is one of the country’s development priorities, having received an increasing level of financial support and incentives for investment from the government over the years.

In the healthcare sector, the medical device industry is one of the most promising subsectors for foreign investors since most medical equipment in Vietnam is imported from international multinational companies. In this Q&A with Filippo Bortoletti, Senior Manager, Hanoi Office, Dezan Shira & Associates, we glean insights about Vietnam’s healthcare industry including a general overview and opportunities for European businesses.

Can you give us a general overview of the healthcare industry in Vietnam?

Vietnam’s healthcare industry can be broken down into three segments: Healthcare services and facilities, pharmaceutical products, and medical devices and equipment. The industry’s estimated turnover was US$17.4 billion in 2018 according to Business Monitor International report.

Factors helping the industry are Vietnam’s fast-aging population, rising per capita income, increasingly urban population, while some drawbacks include counterfeit drugs and a complex regulatory environment.

According to the local Ministry of Health (MoH), in 2017 public health organizations accounted for 280,313 hospital beds – about 96 percent, while private health organizations accounted for 11,762 hospital beds at 4 percent. While public health organizations account for most hospital beds, private health establishments are growing thanks to tax incentives and tax holidays deployed by the local government to stimulate growth in the segment.

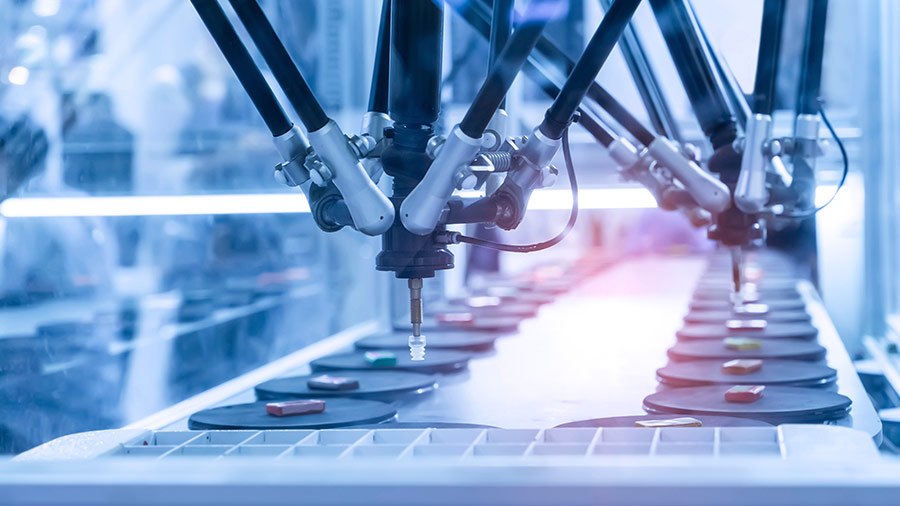

In terms of medical devices, according to the local MoH currently, 90 percent of medical devices in Vietnam are imported, as local production of medical equipment has not been able to meet demand. In fact, local producers are only able to supply basic medical supplies such as hospital beds and disposables. For this reason, the local government encourages the import of medical devices and offers low import duties with no quota restrictions.

The market share of medical equipment is dominated by orthopedic and prosthetic materials at approximately 29 percent followed by paraclinical equipment at 16 percent.

As far as international trade, exports of medical devices have recorded a compound annual growth rate (CAGR) of 18.46 percent from 2015 to 2019 while imports have recorded a CAGR of 12.29 percent in the same period. However, Vietnam remains heavily reliant on imports of certain products such as x-rays and radiation instruments, ultrasonic scanning, and magnetic resonance. Indeed, if we look at imports by products, electromedical instruments and x-rays dominate Vietnam’s import landscape mostly from the EU and the US. For Vietnam’s exports, this is dominated by plastic products and electromedical instruments to Japan and the EU.

What are the major trends of the industry?

There are four major trends currently: The first is good economic fundamentals with rising income per capita, an increasingly urban population, and an aging population as mentioned earlier, the second is heavy reliance on imported pharmaceuticals and medical equipment because local manufacturers cannot meet local demand, thirdly is digitalization, and lastly, is the high international integration of Vietnam through a wide network of free trade agreements aimed at reducing trade and non-trade barriers between Vietnam and other strategic markets.

If we look at local market trends, for medical devices, local manufacturers can only supply basic medical supplies such as scissors, rubber health products, scalpels, hospital beds, and other disposable supplies. Also, domestic drug firms mostly focus on generic products as they lack research and development capabilities as well as capital to invest in new compounds. Regarding healthcare, of the total 85,000 Parkinson cases in Vietnam, 10 percent of them have onset under the age of 40 as per statistics. Also, liver cancer is the leading cause of cancer death in Vietnam killing up to 25,000 people every year. In addition, hepatitis, cirrhosis, and pancreas issues are challenges facing the country’s health sector.

In terms of digitalization, the local MoH has a plan for digitizing patient records and the application of artificial intelligence (AI), the internet of things (IoT), and big data to create information management systems. Many hospitals have already adopted health IT systems such as electronic health records, e-Health, and telemedicine. In addition, each Vietnamese citizen will be issued with a unique health ID card which will be used nationwide connecting health reports.

Lastly, leveraging free trade agreements such as the EU-Vietnam free trade agreement (EVFTA) is an important opportunity for investors. In the EVFTA framework, several tariffs have been removed at implementation, while others will be gradually removed in stages. However, it is important to note that, products must be wholly obtained or sufficiently processed in Vietnam or EU member states to qualify for preferential tariffs under rules of origin guidelines.

In addition, as per the EVFTA, intellectual property rights (IPR) will be intensified and therefore there will be opportunities for all foreign investors and not just for those in the EU. Vietnam will also align with international standards on both pharmaceutical products and medical devices which means that products already certified in the EU will not need additional testing and certification.

Could you describe some market barriers and entry strategies in Vietnam?

For investors considering Vietnam, there are several market entry strategies for entry. We will highlight three main ones.

Investors can enter Vietnam in the form of a representative office (RO) for promotion, marketing, and brand awareness. That said, it is worth noting that a RO is not allowed to conduct direct advertising and marketing for pharmaceutical products, and they are only allowed to provide information about drugs to doctors and sales representatives of licensed pharmaceutical distributors (information about the products must be confirmed by local competent authorities).

Secondly, they can invest by forming a trading company and enjoying preferential tariffs under several free trade agreements (FTAs) and not just the EVFTA.

Finally, businesses can open a manufacturing company in Vietnam with no restrictions on foreign ownership. Entry strategies for manufacturing can be a wholly foreign-owned enterprise (WFOE), mergers and acquisitions (M&A), or a joint venture (JV) with a local partner. Generally, M&As and joint ventures are effective as these save time to obtain permits, etc. But, before deciding on the investment, foreign investors should be aware of the restrictions applied to either pharmaceuticals or medical devices.

Specifically, as far as pharmaceuticals are concerned, foreign-invested enterprises registered in Vietnam can manufacture pharmaceutical products but are prohibited from distributing drugs in Vietnam.

Therefore, pharmaceutical companies with foreign ownership over 49 percent cannot distribute drugs and are only permitted to do conduct wholesale and retail activities with non-pharmaceutical supplements in the form of tablets, capsules, and powder. As a trend in this specific business, more and more foreign pharmaceutical companies are cooperating with local manufacturers to take advantage of cheap production costs and distribution systems.

On the other hand, as far as medical devices are concerned, there are no restrictions on foreign ownership and foreign-invested companies are able to directly distribute finished products in Vietnam without relying on a local partner.

Foreign manufacturers usually sell through local distributors since it offers immediate access to the customer network and knowledge. Nevertheless, investors can choose to invest in local manufacturing facilities to leverage low labor costs and exploit tax incentives.