Vietnam Briefing highlights Vietnam’s fast evolving garment and textile industry – its development, growth, and opportunities for investors after COVID-19.

Vietnam Briefing highlights Vietnam’s fast evolving garment and textile industry – its development, growth, and opportunities for investors after COVID-19.

- Vietnam is among the top textile producing countries and apparel exporters in the world, emerging as an ideal alternative to China.

- Major factors driving industry growth are growing textile exports derived from multilateral free trade agreements and low labor costs.

- Despite rising challenges due to the COVID-19 pandemic, the industry is fast evolving to address its haunted growth, raising optimistic prospects for recovery.

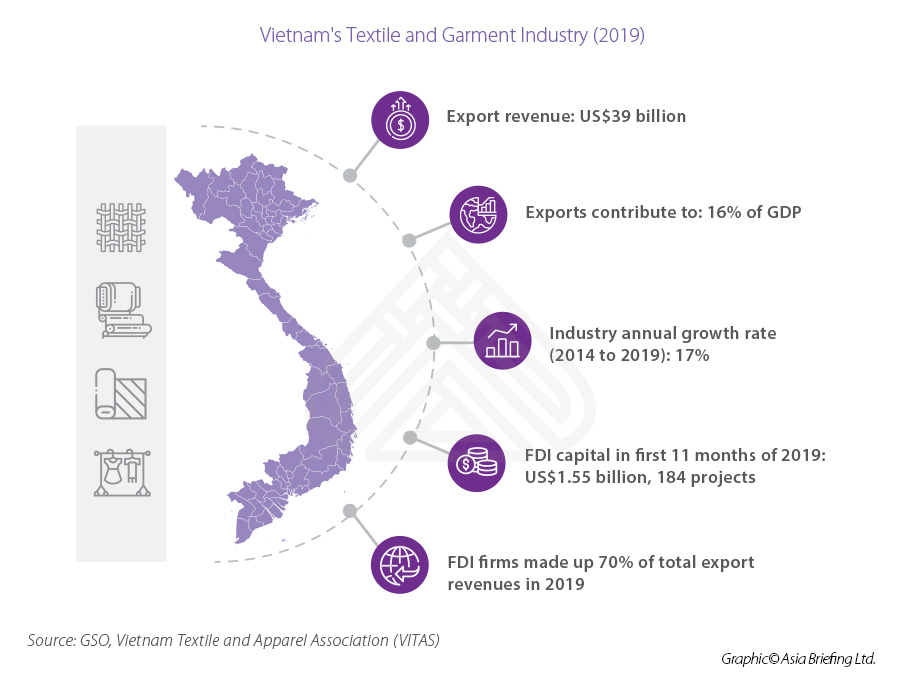

The garment and textile industry is one of the key industries in Vietnam with the second-largest export turnover in the country. In 2019, the industry’s export value contributed to 16 percent of total GDP. In the past five years, the textile industry has continuously grown at an average rate of 17 percent annually.

In 2019, Vietnam’s garment and textile industry earned US$39 billion from exports, a year-on-year increase of over 8.3 percent, according to the Vietnam General Statistics Office. Garment manufacturing accounts for the majority of businesses, at 70 percent. Major factors driving the growth of the market are low labor costs and growing textile exports to the EU, the US, Japan, and South Korea.

Industry overview: 3 sub-sectors

Vietnam’s garment and textile industry consist of 3 sub-sectors: upstream sector (fiber production), midstream sector (fabric production and dyeing), and downstream sector (garment manufacturing).

Sub-sectors that produce fibers or fabric are mainly used for domestic consumption because of the low quality. Downstream sector of garment manufacturing accounts for around 70 percent of the total apparel and textile sector in Vietnam with Cut-Make-Trim (CMT) models being the main activities. In 2019, CMT accounted for about 65 percent of total exports, while the more advanced business models, like Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) accounted for only 35 percent.

The US, Europe, Japan, and South Korea are the main export destinations of Vietnam’s textile and garments products. Although Vietnam has a huge potential for cotton cultivation and production, the textile industry imports most of the cotton inputs. In 2019, Vietnam imported up to 89 percent of fabrics, of which, 55 percent were from China, 16 percent from South Korea, 12 percent from Taiwan, and 6 percent from Japan.

Growth factors – increased market access and low labor costs

Increased market access through free trade agreements (FTAs_ and technology are major growth drivers for the garment and textile industry. Vietnam’s bilateral and multilateral FTAs continue to provide Vietnamese manufacturers access to new markets, minimizing the effect of growing trade protectionism. With new FTAs in effect such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and Vietnam-EU FTA (EVFTA), new markets will lead to higher exports and push manufacturers to develop the industry’s supply chain so that they can take full advantage of the preferential tariffs and increase the competitiveness of their products.

Further, manufacturing shifts from China to Vietnam due to their labor cost advantage and skilled workers will also help expand the textile and garment industry.

Going forward, market access alone will not be enough to generate growth and Vietnamese manufacturers would also need to invest in technology – especially Industry 4.0 technologies – to increase productivity, and quality to remain competitive.

Foreign direct investment

According to the United Nations Conference on Trade and Development (UNCTAD), in the first 11 months of 2019, Vietnam attracted FDI capital to the garment and textile industry with a value up to US$1.55 billion for 184 projects. Investments were led by Hong Kong (US$447 million), Singapore (US$370 million), China (US$270 million), and South Korea (US$165 million).

Tay Ninh, (US$464 million, 16 projects), Quang Nam (US$107 million, 10 projects), Nghe An (US$210 million, 3 projects), and Thua Thien Hue (213 million, 2 projects) are localities that attracted most FDI in 2019 due to government incentives and their proximity to major economic hubs in the Southern and Central parts of Vietnam.

FDI firms made up 70 percent of total garment and textile exports in 2019. In recent years, foreign investment has shifted from mainly CMT activities to more upstream sectors such as fabric productions and dyeing. In 2019, more than 80 percent of FDI in the industry consisted of manufacturing fabrics and raw materials projects.

Besides capital, these FDI firms have provided competition pressure and spill-over benefits that stimulate innovation and growth of domestic producers, as well as help scale-up the industry ‘s capacity in the past three decades.

COVID-19 and Vietnam’s garment and textile industry

With a supply chain that heavily relies on a few key partners, Vietnam’s garment and textile industry is among the country’s hardest hit by the COVID-19 pandemic.

Since January, the suspension of the industry’s input production in China has resulted in a raw material shortage in Vietnam. Meanwhile, a crash in demand from the US and European markets has led to order cancellations as well as revenue and job losses for domestic manufacturers.

According to the Vietnam Textile and Apparel Association (VITAS), garment and textile exports in the first four months fell 6.6 percent year-on-year to US$10.64 billion. Meanwhile, the total import value was US$6.39 billion, down 8.76 percent compared to the same period last year. Exports of fibers, clothes, and garments fell between 6 to 22 percent in the first four months of this year as compared to the same period of 2019.

As per VITAS, 80 percent of garment manufacturers started reducing shifts and rotating workers since March. By June 2020, the estimated loss to the industry was about US$508 million.

Despite this severe, yet temporary setback, Vietnam’s garment and textile industry’s fast response and government policy support are reasons for investors to be optimistic about the industry’s future post-pandemic.

Optimistic prospects for the industry’s post-pandemic recovery

Industry response: Shifting production from conventional clothing to personal protective equipment (PPE)

Many garment producers in the country have shifted to producing face masks as a solution to cope with suspended orders and take the opportunities from surging demand in both domestic and international markets.

By the end of April, Vietnam had exported over 415 million face masks. According to the (MoIT), local manufacturers have a total production capacity of 40 million face masks per day, or about 1.2 billion a month. With full capacity, the entire garment and textile sector can produce 100 million face masks per day, or about 3 billion a month.

Government support policies

Prior to the pandemic, the government had already centered its support for the textile industry by expanding industrial parks for textiles and stimulating the domestic supporting industries. The plan is to increase the supporting industries contribution to 18 percent of production in the local manufacturing and processing sector by the end of 2020. Local governments are also encouraged to assist firms in research and development activities, technology transfer, and innovation.

To mitigate the impact of COVID-19 on businesses, the Ministry of Finance (MoF) has also proposed to extend the list of import tax exemptions for raw materials, supplies, and components for processing and manufacturing export products.

Looking ahead

Although the garment and textile industry is significantly affected by the pandemic, optimistic prospects for fast and strong recovery is possible, given the industry’s response and government’s support policies.

Post-pandemic, Vietnam will focus on moving up the value chain and building a national brand image that is competitive and quality driven, according to a MoIT promotion program. In addition, it also needs to diversify its trading partners and reduce raw input import reliance in order to take full advantage of FTAs, such as the EVFTA, with strict rule of origin conditions.

Note: This article was first published in May 2018, and has been updated to include the latest developments.